Impactful gifts for now and the future.

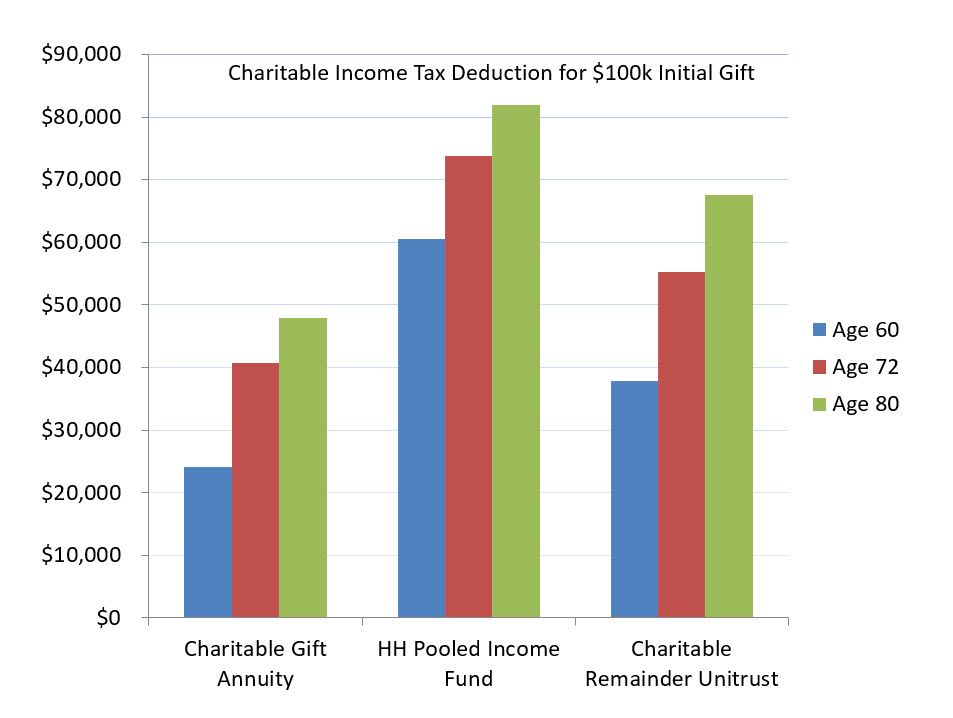

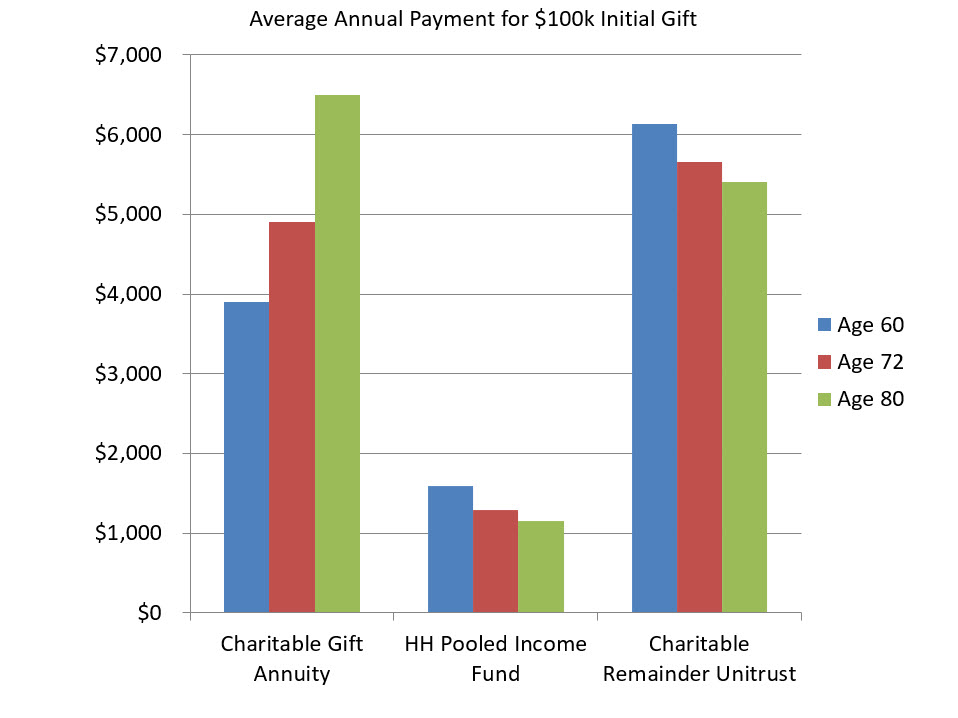

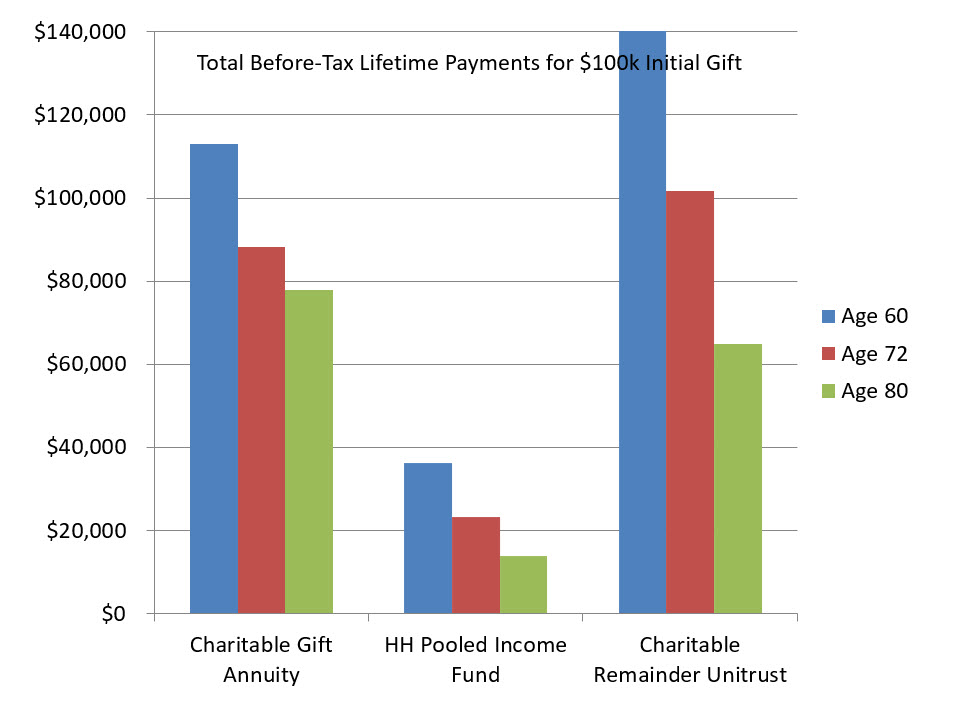

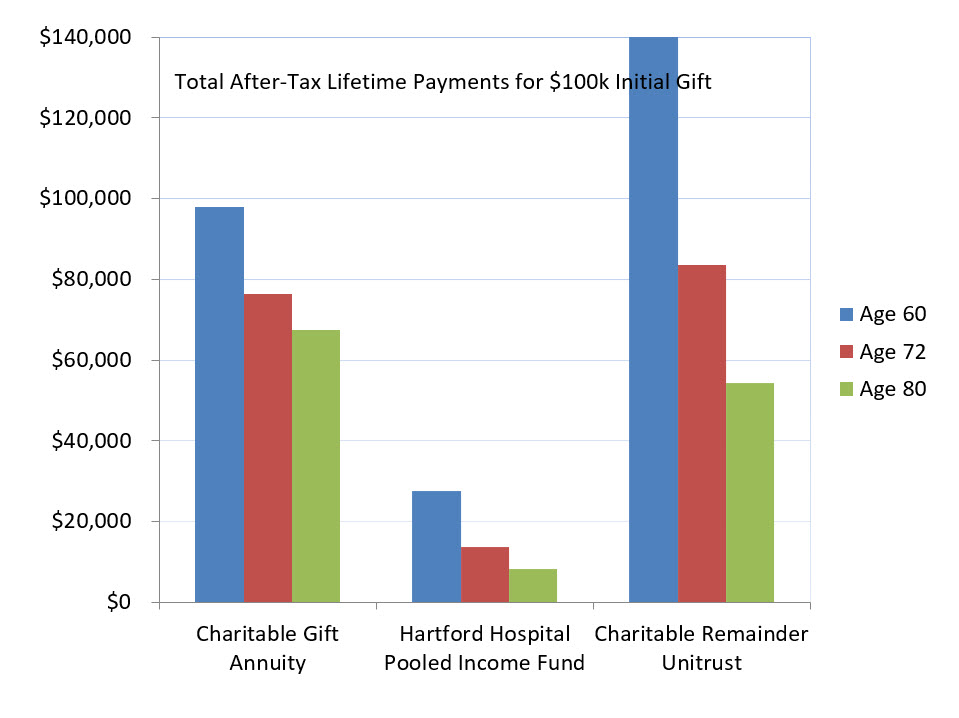

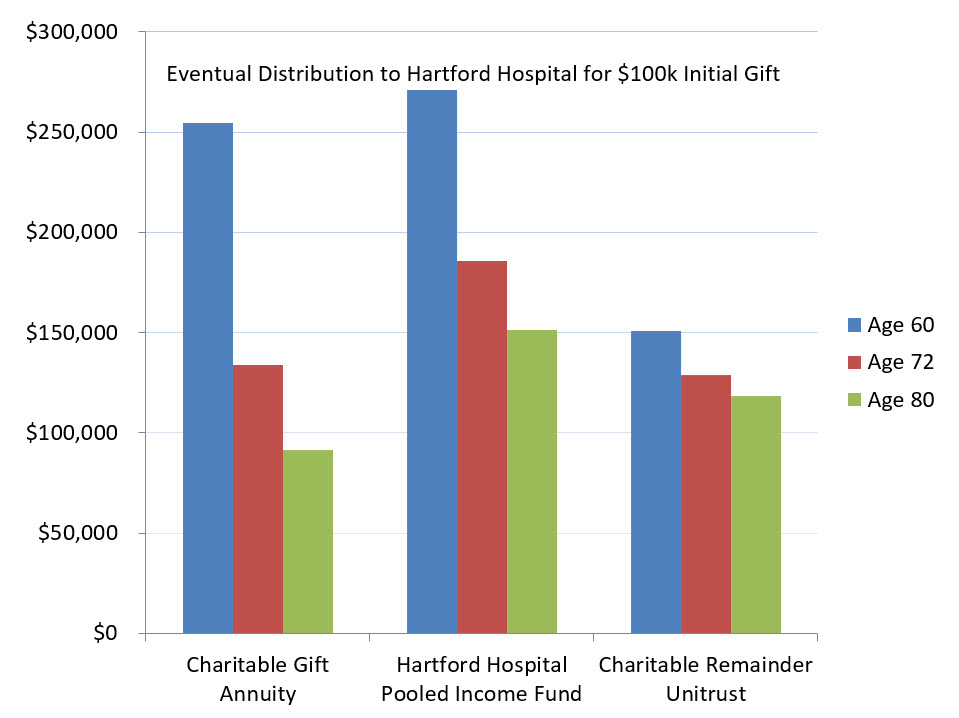

How can you choose the best way for you to make a gift that offers you an immediate charitable income tax deduction, a stream of reliable payments throughout your lifetime, and a remainder benefit for Hartford Hospital that would be worthy of your memory?

Which asset you use, what gift vehicle you choose to fund, your age (or ages) at the time of your gift, discount and payout rates in effect at the time of your gift, and underlying investment performance of your gift’s principal throughout the term of your gift—these will all have an influence on both the immediate and long-term outcomes of your gift plan.

For Charitable Gift Annuities, the older you are at the time of your gift can indicate higher gift annuity payout rates, but in general, choosing a lower rate voluntarily can increase the likely charitable income tax deduction in the year of your gift.

Both the Charitable Gift Annuity (CGA) and the Pooled Income Fund (PIF) have minimum gift thresholds of $10,000.

- Each subsequent CGA in future years creates a new contract with possibly a different rate depending on your age at the time of gift and the rates published and currently in effect, as determined periodically by the American Council on Gift Annuities.

- Charitable income tax deductions are determined differently for the CGA and the PIF. CGA’s are influenced by a combination of the payout rate allowable and the changing Sect. 7520 rate published monthly by the IRS. The PIF’s is based on the past three years’ rate of return on its pooled investments and the age of the donor(s) at the time of the gift.

Charitable Remainder Unitrusts (CRUT’s) are separate trusts and have a higher minimum funding threshold of $100,000 and a minimum payout requirement of 5% of the Fair Market Value of the CRUT’s principal each year.

The taxable nature of the payments from these three life income gift vehicles vary in ways that could be advantageous to you depending on the taxable nature of the donated asset, or assets. Decisions made around these considerations should be discussed with your personal estate planner or other qualified tax professional.

There are several factors to consider when comparing life income vehicles—do you want the highest possible lifelong income stream, the highest immediate charitable income tax deduction, reduction or elimination of long-term capital gains taxes, or a moderation of those factors with the greatest likely benefit to the hospital?

A life income gift is not an investment opportunity. Although in some ways it may have some perceived advantages over a CD or similar investment option, when all comes to fruition, it remains a charitable gift pure and simple.

Charitable Gift Annuities

In exchange for an outright gift, Hartford Hospital agrees by contract to pay a fixed amount each year to you and/or another beneficiary for life.

Learn About AnnuitiesCharitable Remainder Trusts

You establish a trust from which you and/or other beneficiaries receive annual payments of a fixed dollar amount for life and/or a term of years, after which the remainder of the trust assets pass to Hartford Hospital for the purposes you designate.

Get More InfoPooled Income Funds

Your gift goes into an investment pool that functions like a mutual fund. Investment returns are paid to you and/or other beneficiaries for life, after which your gift is withdrawn and used to support your designated purpose at Hartford Hospital.

Find Out More