Gift your retirement assets.

A gift of retirement plan assets can be a surprisingly easy way to reduce potentially very high taxes and provide support to Hartford Hospital.

A gift of retirement plan assets could be right for you if:

- You have an IRA or qualified retirement plan, such as a 401(k) or 403(b).

- You do not expect to use all of your retirement plan assets during your lifetime.

- You have other assets, such as securities and real estate that you want to pass to heirs.

- You may want to provide payments to loved ones after you are gone.

- You would like to make a gift by bequest to the Hospital.

Required Minimum Distributions (RMD) are determined by the IRS and for those born after July 1st, 1949, must be withdrawn (subject to ordinary income tax rates) in the year you turn 72. Those born before June 30, 1949 are subject to the old rules and must begin to take their RMD starting in 2020. Failure to meet these required minimum withdrawals will result in substantial tax penalties.

More Details About Retirement Assets

IRAs and qualified retirement plans

Retirement plan assets are a major source of wealth for many households. For example, you may have hundreds of thousands of dollars invested in your IRA, 401(k), 403(b), or other qualified retirement plan. These plans do not pay tax on the income they earn, or the capital gain realized within the account. This allows the assets to grow faster than if held and invested these qualified plans.

The primary purpose of your retirement plan is to provide you with income during your retirement, but it can also be an excellent source of funds for making charitable gifts during your life and when your plan ends.

Withdrawals are taxed as income

With the exception of the Roth IRA, the money used to fund a qualified retirement plan, such as a traditional IRA, 401(k), or 403(b), has never been taxed. Also, earnings that occur within a qualified retirement plan are not taxed. As a consequence, withdrawals from any of these plans (except for the Roth IRA) are taxed as ordinary income. Your federal income tax alone on a withdrawal from one of these plans could be as high as 37%.

The recently passed SECURE Act substantially changed the rules that govern required minimum distributions by pushing the required beginning date back to age 72, from 70.5

You must start taking withdrawals from your qualified retirement plan once you reach 72 years old. The amount you must withdraw each year is a percentage of the value of your retirement plan as of the last day of the previous year. The percentage starts below 4% for someone who is taking their first “required minimum distribution” and increases with age according to a schedule published by the IRS.

When Required Minimum Distributions (RMD) come into effect after age 72, these same tax-free QCD’s can be used to satisfy your RMD for your account and other accounts of the same kind.

Taxes on remaining retirement assets can be very high

Your family members and other heirs will have to pay income tax on any distributions they receive from your retirement plan after you are gone. In addition, your qualified retirement plan is included in your estate, so if your estate is large enough to owe estate tax, your plan may increase the estate taxes you owe.

Federal income tax alone can be 37%. When you add federal income tax and estate tax together, they can total 62% or more. In states that assess their own taxes on estates, the total taxes on retirement plan assets paid to heirs can be over 62%.

Give retirement plan assets to Hartford Hospital and save taxes

In contrast to your retirement plan assets, your estate will not owe income tax on most of its other assets in addition to estate taxes that may be due. As a result, your estate and heirs will pay lower taxes if you pass your less heavily taxed assets to your heirs, and give your retirement plan assets to charity. Paying lower taxes will mean that more assets will reach your heirs. How much more will depend on the size of your estate, where you live, the other assets you own, and the type of gift you make.

Life income plan options

There are several life income plan options to choose from. The one that is right for you will depend on a variety of factors. Please contact us if you would like to learn more about funding a life income plan with assets from your retirement plan.

Asset Scenarios

Option 1

Make a tax-free gift with an IRA charitable rollover (aka Qualified Charitable Distribution, or “QCD”)

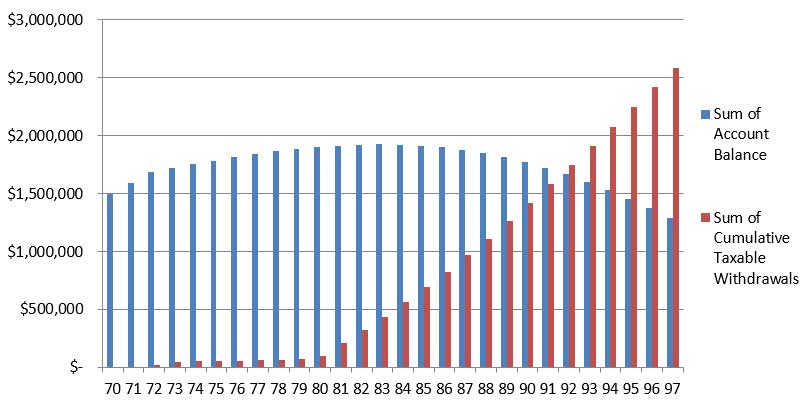

In the chart below, you can see how a 70 year old with an IRA valued at $1.5 million would be only two years away from being required to withdraw as much as $2.5 million as taxable RMD income over the next 20 years or more, resulting in hundreds of thousands of dollars in taxes owed by the accountholder along the way:

You can make an immediate tax-free gift each year after the year in which you turn 70-1/2 by transferring up to $100,000 directly from your traditional IRA to the Hospital (other qualified retirement plans such as 401(k)s and 403(b)s are not eligible). You must be at least 70 ½ years old to take advantage of this opportunity.

The benefits of an IRA charitable rollover gift include:

- Avoiding income tax on IRA withdrawals.

- Supporting the important work of the Hospital with a tax-free gift.

- Satisfying the required minimum distribution (RMD) after age 72.

Option 2

Designate remaining retirement plan assets for Hartford Hospital

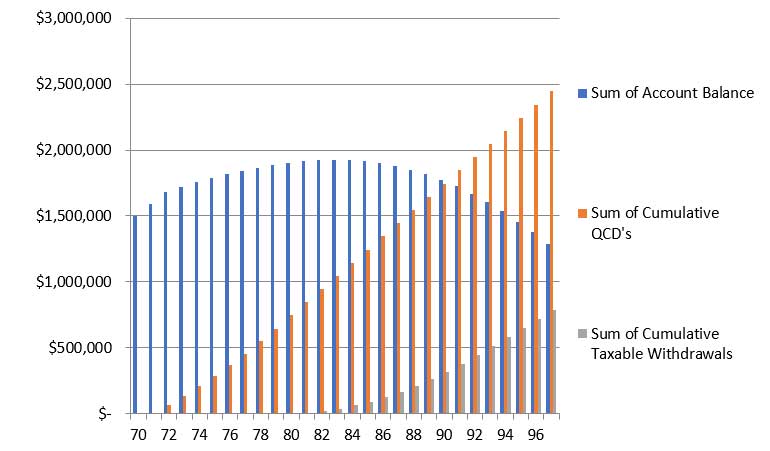

The chart below shows the same IRA account donating its RMD amount each year—up to the maximum of $100,000 per year—using QCD transfers to charity. No income is realized on QCD amounts, so no income tax needs to be paid on those QCD withdrawals, and the amounts attributable to RMD are satisfied after age 72:

Another attractive option is to designate the Hospital as the recipient of some or all of what’s left in your IRA, 401(k), 403(b), or other qualified plan when it ends. While often simpler than drafting a will or revocable trust, care should be taken to avoid unintended and potentially adverse consequences when selecting your beneficiaries. Additional information may be found on this site at here.

Please seek professional tax advice to ensure your planning objectives can be carried out effectively.

In addition to having the satisfaction of making a significant gift to the Hospital, your benefits include:

- Giving your individual beneficiaries, other than your spouse, less of a tax burden when receiving their beneficiary distributions under the SECURE Act.

- Making a gift completely free of federal and state taxes that can total 37% or more, if your estate exceeds the applicable exemption.

- Removing a sizeable asset from the probate process.

Option 3

Designate remaining retirement plan assets for a life income plan

Alternatively, you can designate that some or all of the assets remaining when your IRA, 401(k), 403(b), or other qualified plan ends be used to fund a gift arrangement that will make payments to family members or other loved ones for the rest of their lives. When the gift arrangement ends, what is left will go to Hartford Hospital.

In addition to having the satisfaction of making a significant gift to the Hospital, your benefits include:

- Potentially saving federal and state taxes.

- Preserving non-retirement plan assets for family.

- Providing payments to family or other loved ones for life.

Example

Ty, 69, is a retired business executive who has accumulated $1,500,000 in the retirement plan that he set up through his company years ago. He is aware of the fact that the recent passage of the SECURE Act has moved the start of his RMD from the year in which he turns 70 1/2 to the year he turns 72.

Ty’s tax advisor has explained to him that his RMD will generate more income for him than he actually needs, but he could be reasonably sure that the account would still have substantial value when he eventually passes away.

By making direct charitable transfers of his RMD amounts (via QCD’s) beginning at age 72, Ty learns that not only would he save himself over a million dollars in taxable income over the next 15 years, he could preserve as much tax-free growth inside the plan as possible and deliver substantial charitable gifts each year to one or more of his favorite charitable organizations.

Ty has reached the time in his life when he has also begun thinking about the legacy he wants to leave behind after he is gone. Hartford Hospital has meant a great deal to him and his family, so he would like to create an endowed fund that will perpetuate generous support in his name. After discussions with his advisor and the Hospital’s Philanthropy staff, Ty creates an agreement to establish the kind of fund he envisions, and he designates Hartford Hospital as the final recipient of some or all of the final balance in his retirement account.

Benefits

- There will be no income tax or estate tax on the estimated $1.4 million projected to be remaining in Ty’s retirement plan when it might be transferred to the Hospital 15 years from now.

- If Ty were to pass the same amount to his family—other than his surviving spouse—and make his charitable gift with stock instead, his family could owe income tax of as much as $495,000 (37% bracket) on the IRA assets they would receive, in addition to their own earnings at the time. There could be even greater tax savings if Ty’s estate was large enough to pay estate tax.

- During his remaining years, Ty will enjoy the gratification, feel the profound joy, and realize the impact and enduring value that will come from his annual QCD’s to Hartford Hospital.

- He will also know that, long after he is gone, his support will continue on, and he and his family will be well-remembered for their magnanimity.

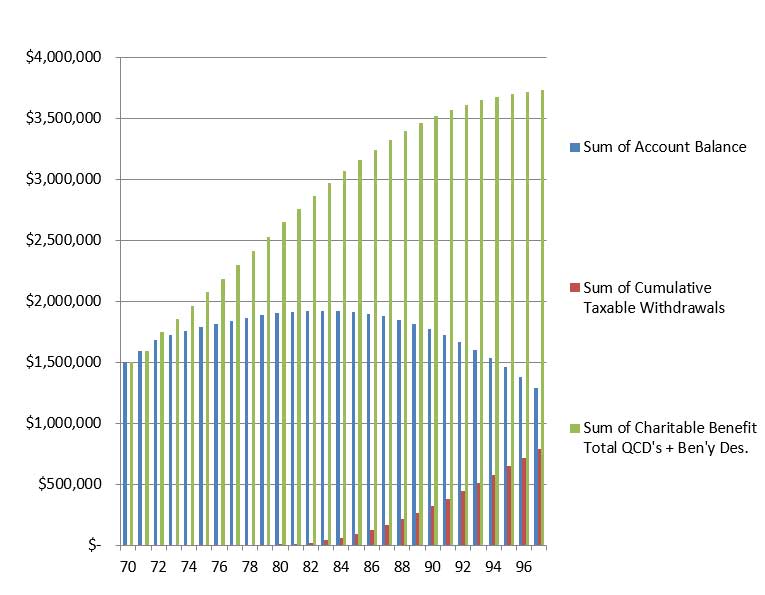

In the chart above Option 3, you can see how, as each year passes, Ty’s QCD’s satisfy his RMD obligations after he turns 72 (as illustrated by the orange columns in the chart above Option 2), and the principal of his account (blue columns) retains its value well into his 90’s. The combination of these accrued yearly tax-free gifts combined with the eventual distribution of the account’s entire principal (green columns), can all add up to a substantial charitable legacy no matter when the ultimate gift actually takes place.

Contact Us

Rob Keane

Senior Philanthropic Officer

Hartford Hospital

860.972.1932

robert.keane@hhchealth.org